The Affordable Care Act (ACA), established in 2010, brought about transformative changes to the healthcare sector, primarily designed to broaden healthcare access across the nation. In addition to expanding coverage, the ACA imposed new duties on employers, fundamentally reshaping their role in the healthcare ecosystem.

A pivotal element of this legislation was the rollout of ACA reporting obligations in 2015, specifically targeting businesses classified as Applicable Large Employers (ALEs). The ACA Employer Mandate serves as a cornerstone of these efforts, demanding active engagement from employers in healthcare provision.

What is the ACA Employer Mandate?

ACA information reporting regulations require employers who meet ALE status to offer minimum essential coverage (MEC) to full-time employees and report these details to the IRS. An ALE is defined as an employer with 50 or more full-time employees or full-time equivalent (FTE) employees during the previous calendar year.

ACA Reporting Requirements by Employer Size

- ALEs (50+ full-time employees): Must file Forms 1094-C (Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns) and 1095-C (Employer-Provided Health Insurance Offer and Coverage). Form 1094-C acts as a transmittal form summarizing the provided information, while Form 1095-C details the nature of the health coverage offered to each employee, affordability details, and employee eligibility for premium tax credits.

- Self-Insured Small Businesses: These entities should file Form 1094-B (Transmittal of Health Coverage Information Returns) and 1095-B (Health Coverage), which report on health coverage. Insurers and self-insured small employers use Form 1094-B for transmitting summarized data, and Form 1095-B to provide specifics on the type of health coverage provided, covered individuals, and coverage duration.

- Small Businesses with Fewer than 50 Employees: There are no ACA reporting requirements unless they offer self-funded health coverage.

The table below provides a quick reference to the forms and their purposes:

| Form | Used by | Recipient | Details |

| Form 1094-B | Self-insured small businesses and insurance providers | IRS | transmittal form that summarizes the information contained in the accompanying Form 1095-B filings. |

| Form 1095-B | Self-insured small businesses and insurance providers | Individual employees |

|

| Form 1094-C | ALEs | IRS |

|

| Form 1095-C | ALEs | Full-time employees |

|

What are the penalties for non-compliance?

The IRS enforces significant penalties under Section 4980H for ALEs that fail to adhere to the ACA’s employer mandate. These penalties fall into two categories: 4980H(a), the “no offer” penalty and 4980H(b), the “Inadequate coverage” penalty.

4980H(a)

The 4980H(a), or “no offer” penalty, applies when an ALE fails to offer minimum essential coverage (MEC) to at least 95% of its full-time employees and their dependents for any given month. If at least one full-time employee receives a premium tax credit through a Health Insurance Marketplace, the employer may face a significant penalty.

How to Avoid the 4980H(a) Penalty: Maintain meticulous records to ensure MEC is offered to the requisite percentage of employees and dependents. Regularly verify and document employee hours and coverage offers through Forms 1094-C and 1095-C.

4980H(b)

Even if an employer offers MEC to 95% of full-time employees, they may still face penalties if the coverage is deemed unaffordable or does not meet minimum value standards. The 4980H(b) penalty is imposed when at least one full-time employee receives a premium tax credit due to inadequate employer-provided coverage.

How to Avoid the 4980H(b) Penalty: Regularly review and adjust health plans to ensure they cover at least 60% of total healthcare expenses and that employee contributions for self-only coverage do not exceed the ACA’s affordability threshold (9.12% of household income for 2023).

How to Meet ACA Filing Requirements with eFileMyForms

To help simplify this essential task, eFileMyForms offers a streamlined, user-friendly platform that takes the stress out of ACA reporting. Whether you’re an ALE or a small business managing self-insured employee plans, eFileMyForms is here to assist you every step of the way.

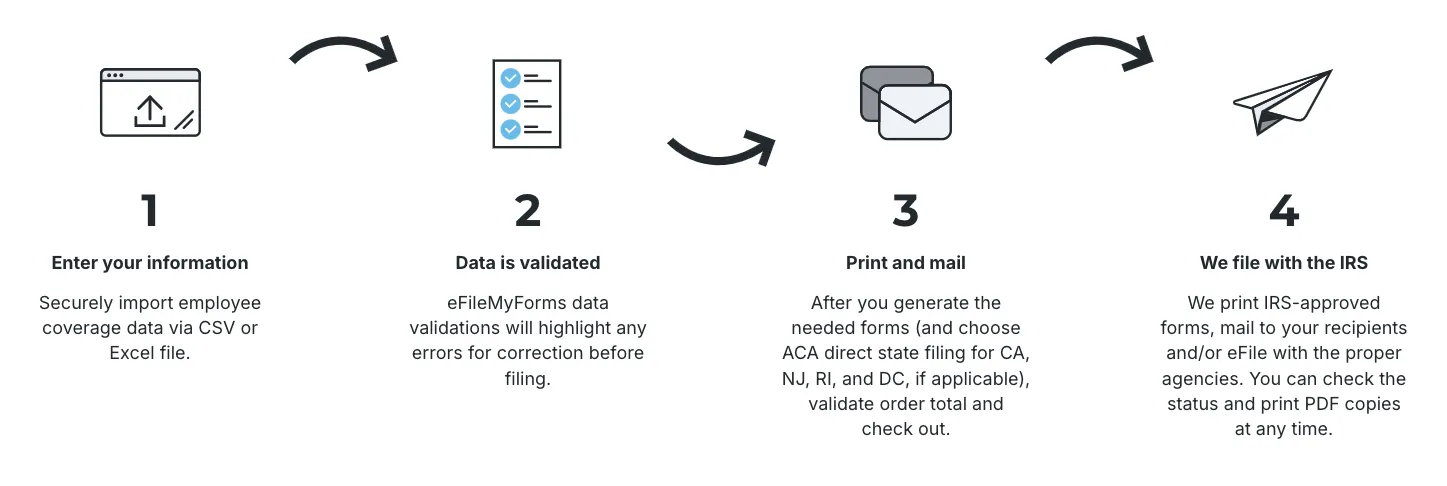

Step 1: Enter your information

Begin by securely importing your employee coverage data. Our platform supports both CSV and Excel file formats, allowing you to upload your data quickly and without hassle. Just navigate to the upload section, select your file, and let our system handle the rest.

Step 2: Data validation

Once your data is uploaded, eFileMyForms automatically checks for any inconsistencies or errors. Our robust validation process highlights any issues that need your attention, ensuring that corrections are made before any filing occurs. This step is crucial for maintaining the accuracy of your reports and minimizing compliance risks.

Step 3: Print and mail state-specific forms

After your data has been validated and all necessary corrections have been made, you’re ready to generate the required forms. If you’re filing in specific states like CA, NJ, RI, and DC, select the option for ACA direct state filing. Confirm the order total, proceed to checkout, and we’ll take care of printing and mailing the forms to the respective agencies and employees.

Step 4: We file with the IRS

In the final step, eFileMyForms takes care of the heavy lifting. We will print the IRS-approved forms, mail them to your recipients, and e-file with the relevant agencies on your behalf. You can track the filing status and access PDF copies of the forms at any time through your account.

Ready to take the hassle out of your ACA compliance process? Get started with eFileMyForms today—no subscription fees required.