The IRS is welcoming a new era of tax reporting with updated electronic filing requirements that aim to streamline processes and improve compliance. Starting with tax year 2024, all U.S. withholding agents must electronically file Form 1042 Annual Withholding Returns for U.S. Source Income of Foreign Persons, marking a major shift from the paper-based submissions of previous years.

These changes, introduced in T.D. 9972, lowered the filing threshold for information returns to just 10 forms in aggregate, impacting a wide range of returns, including 1099, W-2, 1095, and now Form 1042. With the March 15 deadline approaching, businesses must act now to prepare for this transition and navigate the complexities of the IRS’s Modernized eFile (MeF) system.

Understanding the IRS Electronic Filing Requirements for Form 1042

Form 1042 is used to report tax withheld on certain income paid to foreign persons, including interest, dividends, and other payments subject to withholding under Chapter 3 tax rules. Unlike Form 1042-S, which must be distributed to recipients to detail income subject to withholding for foreign persons, Form 1042 is exclusively submitted to the IRS.

Businesses that file 10 or more information returns—including Forms 1099, 1098, W-2, and 1042-S—are required to file electronically. This filing must be completed through the IRS MeF system, which is part of the IRS’s initiative to modernize tax reporting and enhance efficiency. The tax year 2024 deadline for electronically filing Form 1042 is March 15, 2025.

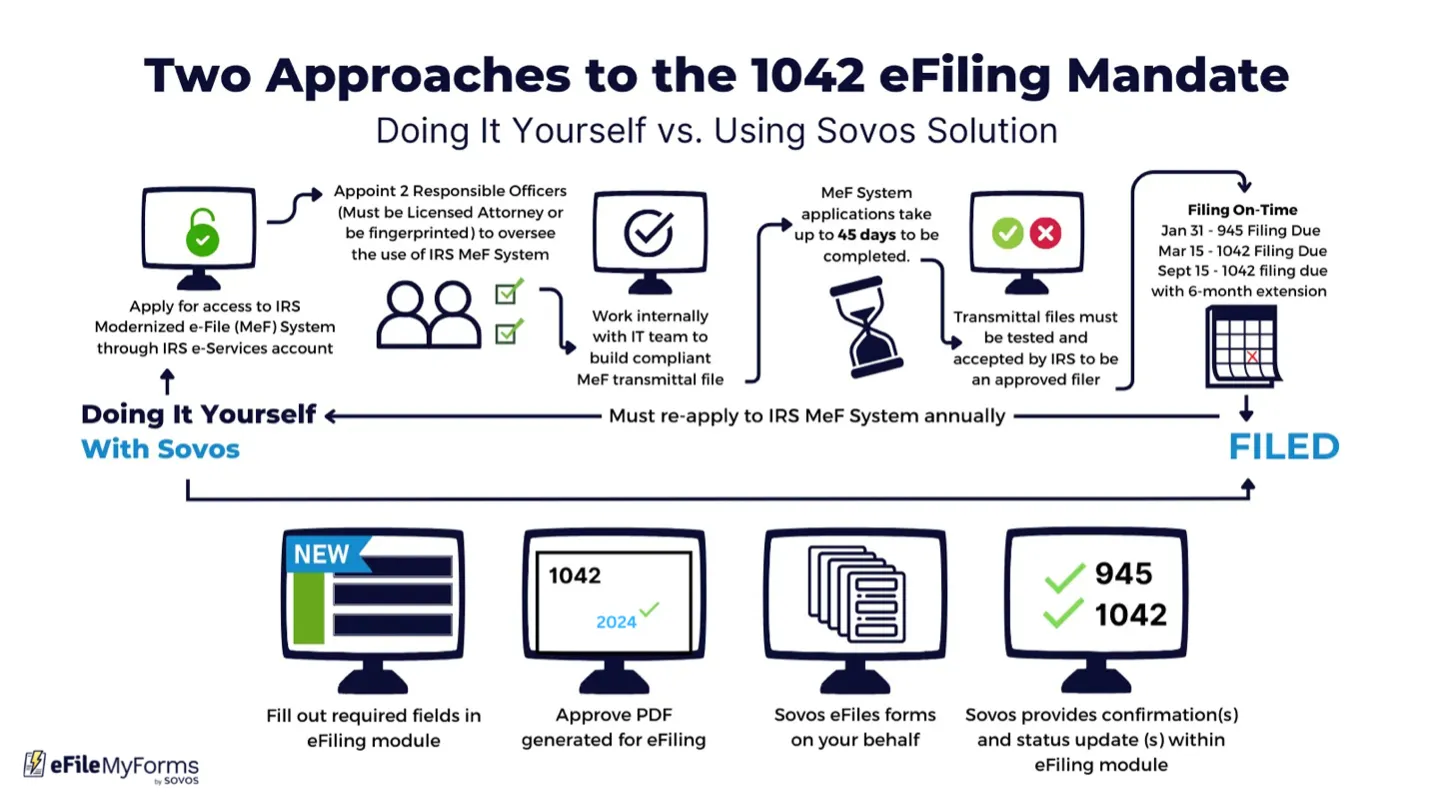

While the intent is to make tax reporting faster and more secure, the upfront challenge of gaining access to the MeF system can be complex and time consuming. It begins with creating an IRS eServices account, verifying your business information, and applying for access to the MeF system—a process that can take weeks or months. Once approved, businesses must obtain a Transmitter Control Code (TCC), a unique identifier required for filing returns. Additionally, MeF access must be renewed annually, adding another layer of responsibility.

Preparing and formatting data for MeF submission can also present challenges, especially for businesses unfamiliar with the system. Many choose to bypass these hurdles by partnering with Sovos, which offers a user-friendly platform that simplifies Form 1042 e-filing, eliminates the need to directly navigate the MeF system, and ensures timely, compliant filings.

Why partner with Sovos for completing Form 1042?

With Sovos, businesses can quickly and efficiently complete their filings through an intuitive platform designed to handle the intricacies of tax compliance. While the MeF requires extensive setup, annual renewals, and technical expertise, Sovos streamlines the entire process, enabling businesses to focus on their core operations instead of navigating IRS processes.

The platform includes built-in validation tools to catch errors before submission, automatic updates to ensure compliance with the latest regulations, and robust support from tax professionals who are ready to assist with any questions. By eliminating unnecessary hurdles, Sovos empowers businesses to meet their filing deadlines with confidence and ease, making it the ideal choice for organizations of all sizes.

Ready to take the stress out of tax season? Start e-filing Form 1042 with Sovos today.