As part of its multi-year business systems modernization plan, the IRS has implemented new systems and processes that must be followed to access their systems to file information returns. With a new process in place, electronically filing information returns requires obtaining access credentials and the first step is to establish an e-Services account with the… Read more »

Corrections Guide for Tax Year 2023

The IRS processes millions of information returns each year, many of which require filing a corrected return. For tax year 2023, the IRS has changed the way in which corrections must be filed. Failure to file your corrections in the proper method can result in potentially costly penalties and extra time-consuming rework. Here is our… Read more »

2023 Tax Form Aggregation: Changes & Compliance Tips

The IRS recently released new requirements around electronic filing of all information returns including Forms 1099, 1098, W-2 and more. The recent change includes a new form volume threshold for electronic filing, which is being lowered from 250 forms to 10 forms. Methodology In tax year 2023, the electronic filing threshold will no longer be… Read more »

Filing Paper Returns – Just Don’t Do It!

We recently had the opportunity to interview James J. Pupelis, CPA, tax specialist, and long-time user of eFileMyForms. During our conversation with James, we hit on several different and interesting topics, one of which was the need to move away from paper returns. Over the past year, the IRS has made changes to the way… Read more »

The Federal-State Filing Program: Benefits & How It Works

The Combined Federal State Filing (CF/SF) program was created more than 20 years ago by the IRS to help lighten the administrative burden on small businesses reporting 1099 information to states. This program aims to help integrate federal and state filings. The IRS uses the information filed in federal returns and then forwards that information… Read more »

State Annual Reconciliation Forms: Why They Matter

What is a State Annual Reconciliation Form and Why Does it Matter to Me? Have you ever wondered what a state annual reconciliation form is and why they must be filed? We’ve answered those questions, and more, in our list of most asked questions regarding state annual reconciliation forms: What is an annual reconciliation form?… Read more »

What You Need to Know About the IRS eFiling Threshold Changes

What You Need to Know About the IRS eFiling Threshold Changes The IRS recently released new requirements around electronic filing of all information returns including Forms 1099, 1098, W-2 and more. The new requirements also include employment tax returns such as Forms 941, 945 and Form 1042. The changes impact 2023 returns filed in 2024… Read more »

Form 1042-S Basics for Small Business

If you are a US based company reporting income paid to a U.S. citizen, you would use one of several 1099 tax forms, such as a 1099-NEC or 1099-MISC. But what’s the protocol for reporting income paid to workers based elsewhere in the world? That answer is form 1042-S. The IRS deadline for both paper… Read more »

IRS Lowers eFile Threshold to 10 Forms for Tax Year 2023

IRS Lowers eFile Threshold to 10 Forms for Tax Year 2023 The Treasury Department and IRS announced changes this week to electronic filing requirements for a number of 1099 forms and Form 1042 (Annual Withholding Tax Return for U.S. Source Income of Foreign Persons). This notice provides final confirmation on the timeline for implementation of many… Read more »

You may have 2022 Affordable Care Act (ACA) state filings due. Is your organization ready?

In addition to federal ACA filing, it’s important to remember that some states have implemented their own mandates that require reporting employee health care coverage directly with the state. Applicable Large Employers (ALE) must also provide copies of 1095-C forms to their employees. Here are a few quick tips to help guide you through the… Read more »

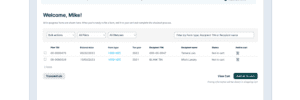

A new eFileMyForms.com experience is here

eFileMyForms.com is now part of the Sovos family of tax compliance solutions. Our depth of experience in 1099, W-2, and ACA reporting has been boosted with the knowledge and expertise of Sovos to deliver an even smoother eFiling experience for you. We’ve completed tax year 2022 form updates and made a number of improvements that… Read more »

IRS Delays 1099-K Reporting Threshold Changes until 2023

IRS Delays 1099-K Reporting Threshold Changes until 2023 The IRS issued Notice 2023-10, delaying the implementation of the 1099-K reporting threshold and transaction limit change until 2023. As a result, third-party settlement organizations (TPSOs) should only report 2022 Form 1099-K to payees when the aggregate of transactions was in excess of $20,000 paid over… Read more »

The Great Resignation to the ‘Great Confusion’ and What It Means for 1099s

The Great Resignation may technically be behind us, but the ripple effects are far from being complete. More than ever people are pursuing a side gig in addition to a job (full- or part-time). In some cases it’s out of economic necessity, while in others it can be for a lifestyle choice or based on… Read more »

Demystifying ACA Reporting

Since the Affordable Care Act went into effect, sorting out the associated reporting obligations has continued to confuse many filers. We’ll attempt to clarify some of the questions in the following post. When it comes to understanding the reporting obligations associated with the ACA, knowing where the individual receives healthcare coverage is the first place… Read more »

Lower eFile Threshold Explained: How It Affects You

The Taxpayer First Act of 2019 authorized the Department of the Treasury and the IRS to issue regulations that reduce the 250 return requirement for electronic filing of information returns. The IRS has previously signaled that the eFile threshold would be reduced to 100 returns for tax year 2021 and 10 returns for tax year… Read more »

Form 1099-NEC & Direct to State Reporting

In 2020, 1099-NEC was resurrected to replace box seven on Form 1099-MISC. This means the 1099-NEC is now the form for reporting non-employee compensation for services amounting to $600 or more. As a result, this form has had a significant impact on all types of businesses and their 1099-MISC reporting processes. With the initial release… Read more »

3 Tips for More Successful 1099 Reporting

Tax information reporting and withholding requirements are constantly changing. You cannot assume that specific requirements will stay the same from one year to the next (or be the same from one state to the next). Here are three keys to staying on top of your 1099 reporting: The IRS and state Departments of Revenue (DOR)… Read more »

The Importance of TIN Matching: Reduce IRS Penalties

Avoid errors and costly fines by verifying your Tax identification numbers (TINs) in advance of the hectic January reporting season. Matching of your recipient’s name and Social Security Number (SSN) or Employer Identification Number (EIN) will compare your recipient data with IRS records to ensure your information is correct and avoid time-consuming and potentially expensive… Read more »

What is TIN matching?

It’s called a TIN – and it’s an essential number when filing W-2s, 1099s, and ACA forms. For most 1099 reporting, a TIN may be a Social Security Number (SSN) or Employer Identification Number (EIN). Why is it important? Because when you are filing your W-2’s or 1099’s, your recipient TIN and name must be… Read more »